Stock Order Book Explained

Stock Order Book Explained. They're the programs that take our forecasts, actual orders, safety â ¦ â ¦ 2. A matching engine uses the book to determine which orders can be fully or partially executed.

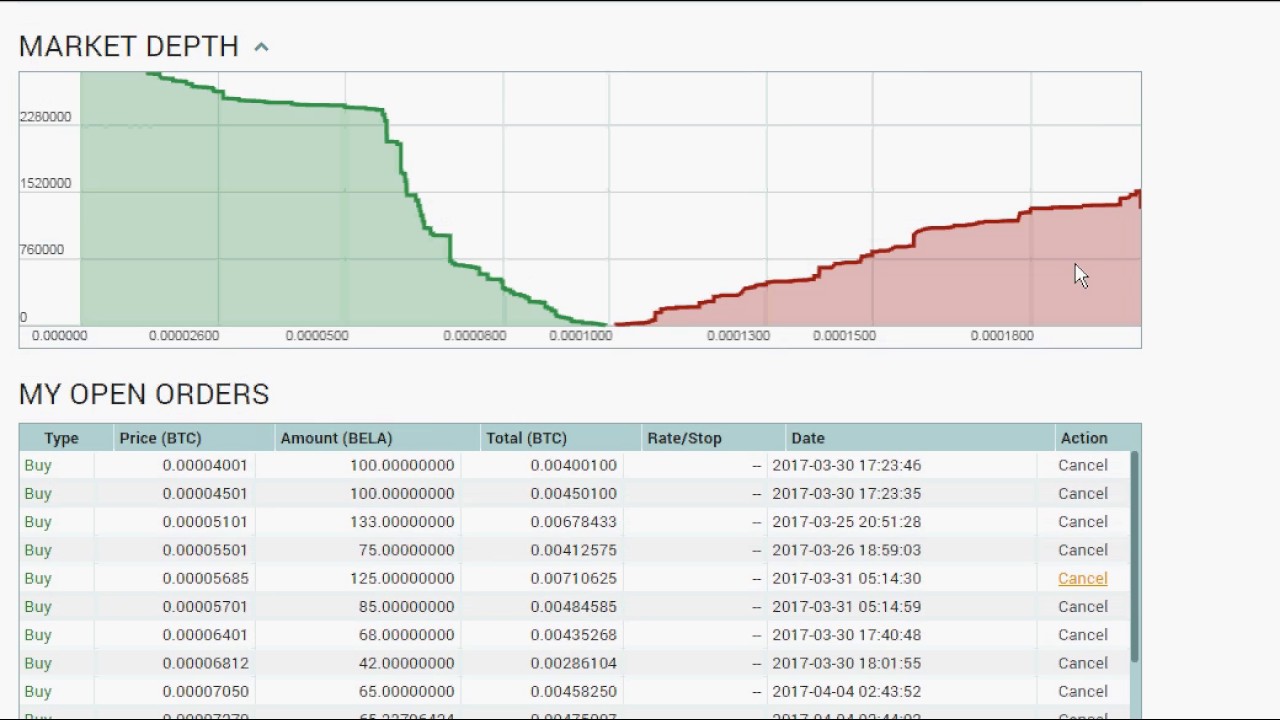

The iob connects worldwide investors in one time zone and market. This information is displayed on two sides of the order book known as the. The order book sorts open orders by price — each unique order price gets a row, and the quantity (amount to buy or sell) of every order at that price is combined in its row.

The Order Flow Trading Platforms Allows You To Trade Directly On The Stock Exchange Through An Order Book Or Chart Trader.

The role of the stock exchanges. Level ii is also known as the order book because it shows all orders that have been placed and are waiting to be filled. The most common example is the order being fulfilled based on the current market demand and supply.

An Entry In The Order Book Contains The Price (Ask Or Bid), The Size Of The Order And The Total Amount To Get Executed.

The order book of a stock is a list of buy and sell orders organized by price level and ecn. The sum column is a running total of the combined orders at this price level. Besides, there are a lot of tools that can make it easier to understand the order flow.

In Addition, It Is Commonly Referred To As The Order Book, Given It Shows A Range Of Orders That Have Been Placed And Are Waiting To Be Filled.

A buy stop order is entered at a stop price above the current market price. An order book lists the number of shares being bid on or offered at each price point, or market depth. The order book the order book displays all orders that are currently p l aced for a specific trade pair on an exchange (i use deeponion/btc on cryptopia as an example here).

The Level 2 Is An Order Book And Simply Displays The Orders That Are Live In The Market.

Order books are organized in such a way that the highest bid and lowest ask are always on the top of the order book, as they are the first to get consumed. They're the programs that take our forecasts, actual orders, safety â ¦ â ¦ 2. Each recorded order will show the total amount and price.

A Matching Engine Uses The Book To Determine Which Orders Can Be Fully Or Partially Executed.

Using market orders and limit orders. The order book is organized by price level. This information is displayed on two sides of the order book known as the.

Post a Comment for "Stock Order Book Explained"